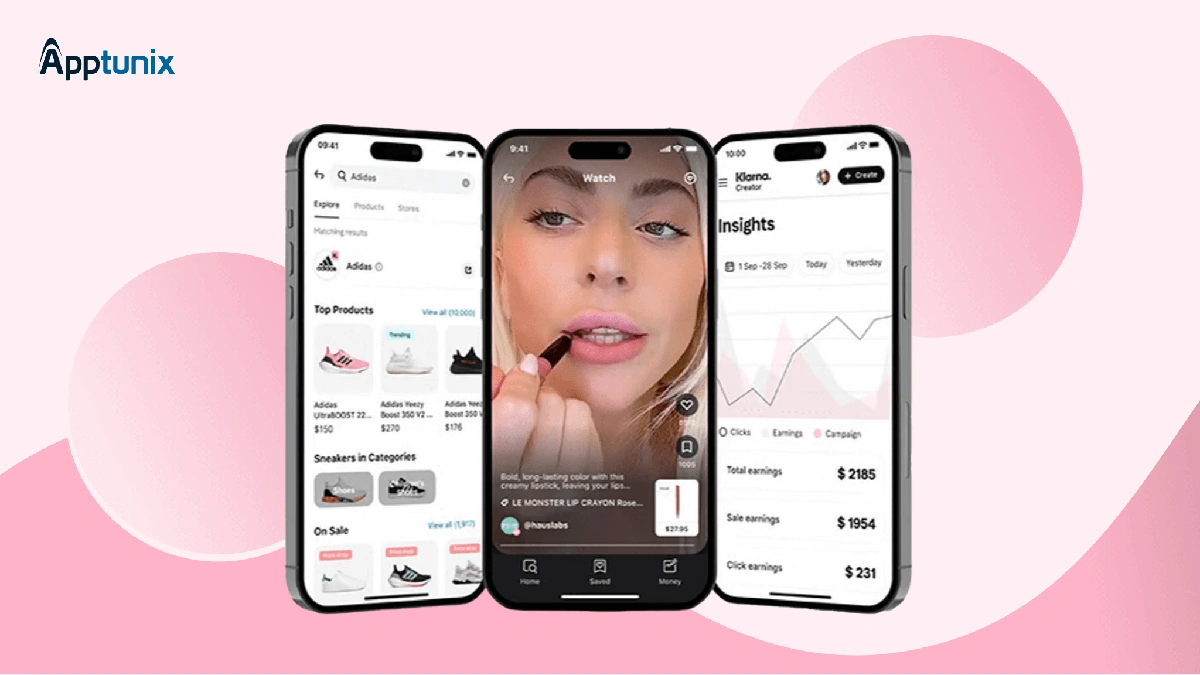

Klarna. You’ve probably seen it popping up at checkout, promising to split your payments into manageable chunks. But , let’s be honest, it’s way more than just a trendy ” buy now, pay later ” (BNPL) service. It’s reshaping how we think about shopping and, maybe more importantly, how we manage our finances. What fascinates me is how this seemingly simple concept is creating waves, both good and bad, in the world of e-commerce and personal finance.

The Allure of Instant Gratification (and the Potential Pitfalls)

So, why is Klarna so darn popular? The allure is undeniable. That new gadget, that must-have fashion item – suddenly within reach, even if your bank account isn’t quite ready. It’s the ultimate instant gratification button. But , here’s the thing: instant gratification can be a slippery slope. It’s incredibly easy to overspend when the pain of payment is delayed and diluted into smaller installments.

I initially thought this was straightforward, but then I realized the psychology at play. Klarna and similar services tap into our natural desire for immediate rewards. And that’s where the potential danger lies. What happens when those “manageable” payments start to pile up? What happens if you miss a payment?

A common mistake I see people make is not fully understanding the terms and conditions. Before you click that ” pay later ” button, take a moment to read the fine print. What are the interest rates (if any)? What are the late payment fees? What is the impact on your credit score ? These are crucial questions to answer before diving in.

Klarna’s Impact on Retailers | A Double-Edged Sword

It’s not just consumers who are affected. Retailers love Klarna because it can boost sales. By offering a more flexible payment option, they can attract customers who might otherwise hesitate to make a purchase. It’s a way to lower the barrier to entry and convert browsers into buyers.

But , there is a downside. Retailers pay a fee to Klarna for each transaction. This can eat into their profit margins, especially for smaller businesses. Plus, there’s the risk of increased returns, as customers might be more likely to buy impulsively when they don’t have to pay the full amount upfront.

The one thing you absolutely must double-check before integrating with Klarna as a retailer is their fee structure and reporting. Make sure you understand exactly how much you’re paying per transaction and how Klarna handles returns and chargebacks. As per the guidelines mentioned in the information bulletin, failure to do so can lead to unexpected costs and headaches down the road.

Is Klarna Safe? Navigating the Security Landscape

Let’s address the elephant in the room: is Klarna safe? With any online financial service, security is paramount. Klarna uses a variety of measures to protect your data, including encryption and fraud detection systems. However, no system is foolproof.

Here’s the thing: you also have a role to play in keeping your account secure. Use strong, unique passwords. Be wary of phishing scams. And monitor your account activity regularly. If you see anything suspicious, report it immediately to Klarna.

According to the latest circular on the official Klarna website , they offer buyer protection policies, but understanding the nuances of these policies is vital. Always review their terms to understand what’s covered and what’s not.

Klarna Alternatives | Weighing Your Options

Klarna isn’t the only player in the BNPL game. There are plenty of alternatives out there, each with its own pros and cons. Affirm, Afterpay, and PayPal’s “Pay in 4” are just a few examples.

The key is to compare your options and choose the one that best fits your needs. Consider factors like interest rates, fees, credit score impact, and retailer availability. And remember, just because a service is available doesn’t mean it’s the right choice for you.

A common mistake I see people make is not considering the long-term implications of using BNPL services. While they can be a convenient way to spread out payments, they can also lead to debt if not managed responsibly. It’s about responsible spending .

The Future of ‘Buy Now, Pay Later’ | A Glimpse into Tomorrow

The “buy now, pay later” trend is here to stay. But , it’s likely to evolve. We’re already seeing more integration with traditional banking services and increased regulation from government agencies.

What fascinates me is how this technology will shape the future of retail. Will it lead to more sustainable consumption patterns, or will it fuel a cycle of debt? The answer, I suspect, lies in how we educate consumers about responsible financial habits.

Check out the latest trends in artificial intelligence news and how it’s impacting financial technology. Additionally, understanding the dynamics of TSM stock can provide insight into the broader economic landscape affecting payment solutions like Klarna .

FAQ About Klarna and ‘Buy Now, Pay Later’

What if I can’t make a Klarna payment?

Contact Klarna immediately. They may offer options like payment extensions or hardship programs.

Does using Klarna affect my credit score?

It can. Some Klarna options report to credit bureaus, especially if you miss payments.

Is Klarna a safe way to pay?

Klarna uses security measures, but it’s crucial to protect your account with strong passwords and monitor for fraud.

Can I use Klarna everywhere?

No, only at retailers that have partnered with Klarna.

What are the alternatives to using Klarna?

Affirm, Afterpay, and PayPal’s “Pay in 4” are popular alternatives. Consider interest rates , fees, and retailer availability.

Ultimately, using Klarna or any “buy now, pay later” service is a personal decision. Do your research, understand the risks, and use it responsibly. It can be a tool, but like any tool, it can be misused. The key is to be informed and make smart financial choices. Klarna’s popularity is due to its convenience, but that convenience comes with responsibility. Online shopping has never been easier, thanks to services like Klarna, but that ease should not translate to impulsive and reckless spending. Consider these alternatives to Klarna when managing finances . Finally, remember that responsible usage is important for one’s credit score .